Marking to Market: A Second Look

Watson Wyatt - Insider, February 2006

A couple of months ago, Watson Wyatt projected the effects of phase 1 of the Financial Accounting Standards Board's (FASB) proposal to change accounting standards for pensions and postretirement benefit plans (see Watson Wyatt Insider, December 2005). Phase 1 focuses on disclosing the funded status of postretirement benefit obligations on corporate balance sheets. The new requirements would eliminate all smoothing of actuarial gains and losses in the funding position that flows into the other comprehensive income section of shareholder's equity.

As the details of FASB's approach have evolved, we have undertaken a second analysis. We again relied on Watson Wyatt's database on the U.S. pension finances of FORTUNE 1000 sponsors for fiscal year-end 2004, the most recent year for which data are available.

To evaluate the effects of changes to FAS 87 and FAS 106, we looked at the difference between a plan's funding position - calculated as the projected benefit obligation (PBO) minus the market value of assets - and the net amount recognized on the balance sheet.1

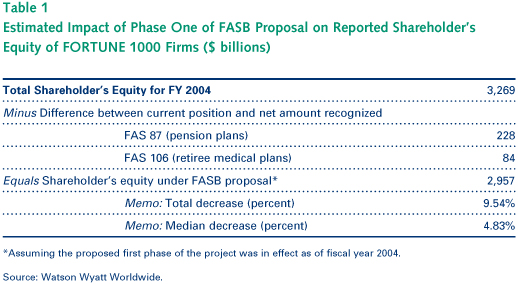

To estimate the after-tax effect, we assumed a 35 percent tax rate effect on the difference between PBO underfunding and the net amount recognized on the balance sheets for FAS 87 and FAS 106. Table 1 shows the outcome of this calculation.

The FASB's approach would significantly reduce shareholder's equity. The aggregate decrease for pension and retiree medical plans combined is 9.54 percent, while the median decrease is 4.83 percent. Interestingly, phase 1 would hit FAS 87 more than 2.5 times harder than it would hit FAS 106.

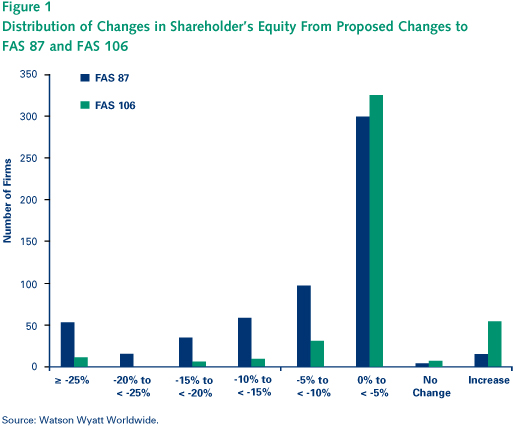

As shown in Figure 1, the effect on shareholder's equity would be highly skewed. While for some plan sponsors, the impact would be minimal, many firms would have to report notably lower shareholder's equity. The hardest hit would be poorly funded plans with large actuarial losses that would have to be recognized on the balance sheet. A few companies would actually report an increase in shareholder's equity under the proposed change, mostly owing to the changes in FAS 106 reporting.

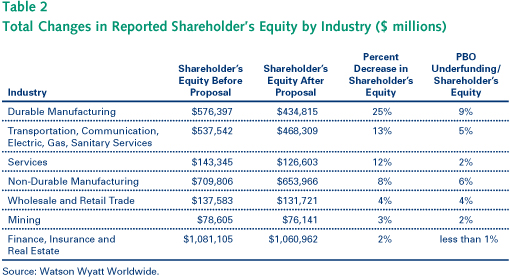

The effect of the proposed accounting changes would also vary significantly by industry. As shown in Table 2, durable manufacturing would take the biggest hit to shareholder's equity, partly because this industry is saddled with both the highest dollars of underfunding to shareholder's equity and a heavy load of postretirement health obligations. The finance industry occupies the other end of the spectrum.

Conclusion

With both studies achieving fairly similar results, two fundamental questions remain: How does the market view pension accounting? And will the FASB's changes to the accounting rules have a negative effect on defined benefit plan sponsorship?

Dramatically lower shareholder's equity on corporate balance sheets may not affect the share prices or the credit terms of sponsoring companies if the market already makes the adjustment the FASB is proposing. Pension plans' funded status is readily available in the footnotes to companies' financial statements, and both credit and equity analysts have developed explicit methodologies for analyzing the effects of postretirement benefits on both the income statements and the balance sheets of sponsoring firms.

Investors in large industrial firms with prominent postretirement obligations are most likely fully aware of the funded status of these plans. But investors may be less aware of funding deficits in plans that consume a smaller share of total company obligations and market value.

Despite all the recent media attention and higher PBGC premiums (see "Congress Increases PBGC Premiums"), even a significant decline in reported shareholder's equity may not drive more corporations to freeze or close their defined benefit plans. First, a defined benefit plan's funded status is already available. And due to the long-term nature of legacy liabilities, any financial relief from freezing or closing a plan would be many years down the line. Finally, to the extent that firms are paying competitively, the market isn't likely to reward companies that freeze their plans.

1 The PBO is currently FASB's preferred measure of liabilities and so would be used to determine funding status in phase 1. The second phase would revisit whether the PBO, the ABO or another measure would most accurately capture pension liability.

INSIDER - February 2006